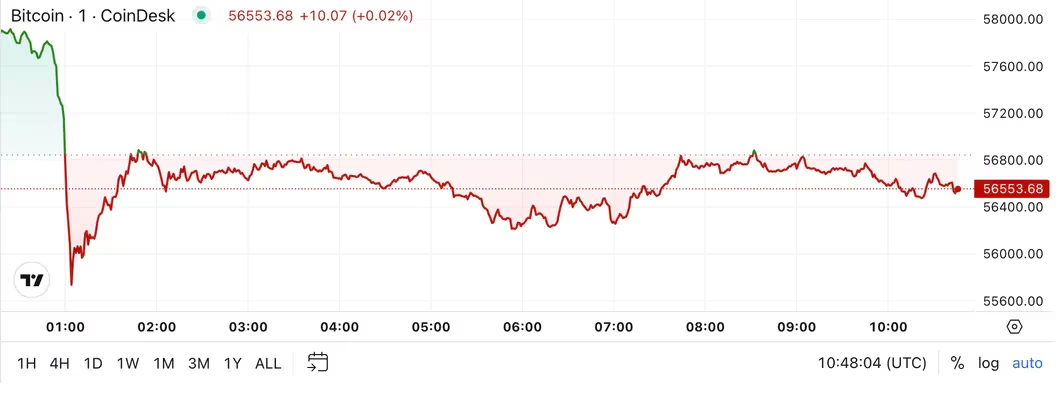

Bitcoin fell below $56,000 during the Asian morning, the lowest since Aug. 8, reversing nearly all of the past month's gains. BTC subsequently recovered some ground, trading above $56,500, still more than 4% lower in the last 24 hours. The CoinDesk 20 Index (CD20), a broad measure of the digital asset market, has fallen around 3.5%. U.S. stocks tracked by the Nasdaq 100 and S&P 500 indexes fell as much as 3.5% on Tuesday to kick off a historically bearish September as weak U.S. manufacturing data reignited concerns over an economic slowdown. The move spread to Asian markets with Japan's Nikkei 225 sliding more than 4%.

Bitcoin mining profitability is stuck at record lows, JPMorgan said in a new research report. "We estimate bitcoin miners earned an average of $43,600 per EH/s in daily block reward revenue in August, the lowest point on record," the analysts wrote. That compares with a peak value of $342,000 in November 2021, when the BTC price was $60,000 and the network hashrate was 161 EH/s. The network hashrate, a proxy for competition in the industry and mining difficulty, increased for the second straight month in August, JPMorgan noted. "The network hashrate averaged 631 EH/s in August, up 16 EH/s from last month, and about 20 EH/s below prehalving levels," the authors wrote.